Demonetization: Its concepts and effects on India and its citizens

Demonetization is a process of withdrawing or removing the status of currency units as a legal tender. In this case money in the form of notes, coins and sometimes precious metal is pulled out from circulation and its replaced with new ones. Most of the times during demonetization, the old currency are completely replaced by new currency.

Usually countries take this extreme step to stabilize the value of currency or combat inflation. When a country takes such a decision there is a drastic intervention into the countries economy because it directly affects the medium of exchange for all economic transactions. Demonetization can help to stabilize existing economic issues or it can create a downturn in the economy if it goes wrong.

The Coinage act of 1873 demonetized silver coins as a legal currency of the United States, and adopted gold as the new legal currency. But this had a huge effect on the economy and resulted in a recession. Hence, a new act called Bland Allison Act was brought into force to remonetize the silver coins.

Few countries have demonetized currencies in order to facilitate trade or form currency unions. In 2001 the nations in the European Union agreed to have a common currency, “Euro” as their legal currency for transactions.

India witnessed demonetization on 8th of November 2016, as the Indian Prime Minister Narendra Modi announced the retirement of all 500 and 1000 rupee notes.

Previously the Indian Government had conducted the process of demonetization on two previous occasions – Once in 1946 and once in 1978. On both of these occasions the goal of the government was to combat tax evasion via black money.

The main objective for the 2016 demonetization as seen by Narendra Modi was:

- To curb tax evasion

- To reduce the cash circulation, directly reduces the corruption rate

- To eliminate the circulation of fake currency which was being used by the terror groups

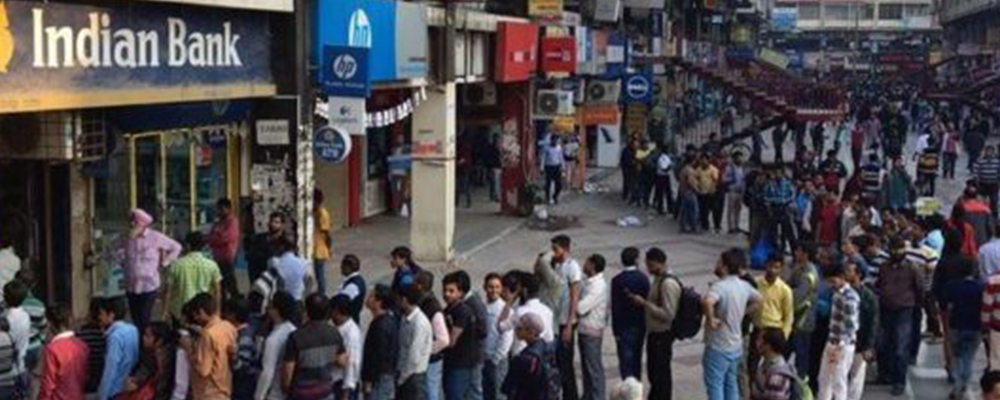

The decision to demonetize the biggest denominations of Indian currency system (i.e 500 & 1000) with immediate effect created a chaos in a cash-dependent country like India. The citizens had time till December of 2016 to deposit or exchange those notes with the newly introduced 2000 & 500 notes.

“ 78% of all transactions were made with cash before demonetization.”

During this period, the daily wage workers, small business and households struggled to find cash. The rupee fell sharply against the dollar during this time.

The purpose of this act was to move India towards tax compliant society from tax noncompliant society. The main objectives of demonetization were to reduce the black money which includes money generated from corruption, illegal activities, untaxed money, market of illegal goods and untaxed money. The other objective of the government was to integrate the informal economies (i.e transactions made in khirana stores, farmers etc where most of the transactions happens with cash) with formal economies which is accounted and taxable.

This action also helped in formulation of economy and a blow to black money. Meanwhile RBI (Reserve Bank of India) said that 99.3% demonetised money is back with banks. Never think that this exercise failed. As citizens of India, you should understand that just because all the cash is returned, doesn’t mean everything is legal money.

Once the cash gets deposited to their bank accounts, owner loses anonymity and all exchanged currency get accounted. Digitalization helps the IT department to account for the cash deposited and income declared by the individuals.

To better understand leaders visit

RBI in its report stated that more than three lakh crores of black money got deposited in banks during this act of demonetization.

Advantages of Demonetization:

- Large amount of money was hidden in the form of unaccounted cash by the tax evaders and demonetization made the government to uncover it. This also helped to accelerate the Indian economy by de-accelerating the parallel economies.

- Government started to generate good amount of tax, since people started to reveal their incomes by depositing money in their accounts. And this turns out to be the major contribution for the development of the country.

- Demonetization helped to terminate funding for terrorism and other illegal activities.

- The act of inflating the value of gold, land properties got reduced. Previously the major part of value transactions were made through black money.

- Due to digitalization, most of the current financial activities are on track and can be easily seized by the authorities if anyone involved in money laundering activities.

Disadvantages of Demonetization:

- People who have kept their savings in the form of cash only got affected but the other forms like gold, real estate etc were not affected by this action of demonetization.

- The major disadvantages was that the process was not completely done according to the plan or it was not planned correctly. Demonetization made people to stand in queues for hours in front of ATM’s and Banks for cash. The situation was even worse in villages and rural areas where people struggled to withdraw and exchange notes with the older one due to a smaller number of ATM’s and Banks.

- The Indian GDP growth rate dropped by 2% for the financial year 2016-2017. This was lowest since 2014.

According to our understanding the purpose of 2016 demonetization was moderately successful. But it could have been planned, organized in a much smoother and better way. The important objective of eradicating black money and corruption was partially successful. The other objectives like crime reduction, and destabilize separatist terrorist organizations was most successful.

Do send us your opinions!